Introduction to Prostatitis

Prostatitis, a condition that many men may encounter in their lifetime, is often misunderstood or overlooked due to its complex nature. This article aims to shed light on this important men's health issue.

What is Prostatitis?

Prostatitis is a term that refers to inflammation or infection of the prostate gland. The prostate is a small, walnut-sized gland that plays a crucial role in the male reproductive system. It produces seminal fluid, which nourishes and transports sperm. Prostatitis can affect men of all ages but is more common in men aged 50 or younger. The condition can be acute or chronic, with the acute form being less common but more severe.

There are four types of prostatitis:

- Acute bacterial prostatitis

- Chronic bacterial prostatitis

- Chronic prostatitis/chronic pelvic pain syndrome

- Asymptomatic inflammatory prostatitis

Each type has its own set of symptoms and treatment options, which we will explore in detail later in this article.

Importance of the Prostate Gland

The prostate gland is an integral part of the male reproductive system. It is located just below the bladder and surrounds the urethra, the tube through which urine and semen exit the body. Its primary function is to produce a fluid that, together with sperm cells from the testicles and fluids from other glands, makes up semen.

"The prostate gland, despite its small size, plays a pivotal role in male fertility and overall urinary health."

Any inflammation or infection of the prostate gland, such as prostatitis, can lead to discomfort, urinary problems, and sexual dysfunction. Understanding the importance of the prostate gland underscores the need for men to take any symptoms of prostatitis seriously and seek medical attention promptly.

Types of Prostatitis

Prostatitis is not a one-size-fits-all condition. It comes in several forms, each with its own set of symptoms, causes, and treatment options. Let's delve into the four main types of prostatitis.

Acute Bacterial Prostatitis

Acute bacterial prostatitis is the least common but most severe form of prostatitis. It is caused by a bacterial infection and can come on suddenly with severe symptoms. These may include fever, chills, and urinary issues such as pain during urination, frequent urination, and the urgent need to urinate.

Immediate medical attention is required for acute bacterial prostatitis to prevent the infection from spreading and causing further complications. Treatment typically involves antibiotics to clear the infection.

Chronic Bacterial Prostatitis

Chronic bacterial prostatitis, as the name suggests, is a long-term condition. It is characterized by recurrent urinary tract infections (UTIs) caused by bacteria in the prostate. Symptoms can be similar to acute bacterial prostatitis but are typically less severe and can come and go over several months.

Treatment usually involves long-term antibiotic therapy, but it can be challenging to treat due to the difficulty of antibiotics reaching the prostate.

Chronic Prostatitis/Chronic Pelvic Pain Syndrome

The most common form of prostatitis is chronic prostatitis/chronic pelvic pain syndrome (CP/CPPS). The cause of CP/CPPS is not well understood, but it's thought to be related to a combination of factors, including nerve damage, stress, and possibly, an unrecognized infection.

Men with CP/CPPS may experience chronic pain in the pelvic area, difficulty urinating, and sexual problems. Treatment often involves a combination of medications, lifestyle changes, and sometimes, physical therapy.

Asymptomatic Inflammatory Prostatitis

Asymptomatic inflammatory prostatitis is a bit of a medical mystery. Men with this type of prostatitis have inflammation in the prostate but no symptoms. It's often discovered during tests for other conditions, such as infertility.

As the condition causes no symptoms, treatment is usually not necessary. However, it's important to monitor the condition as it may increase the risk of developing other prostate conditions, including prostate cancer.

Symptoms of Prostatitis

Prostatitis can manifest in a variety of symptoms, which can vary depending on the type of prostatitis. Some men may experience severe symptoms, while others may have mild discomfort or even no symptoms at all. Understanding the common symptoms can help in early detection and treatment.

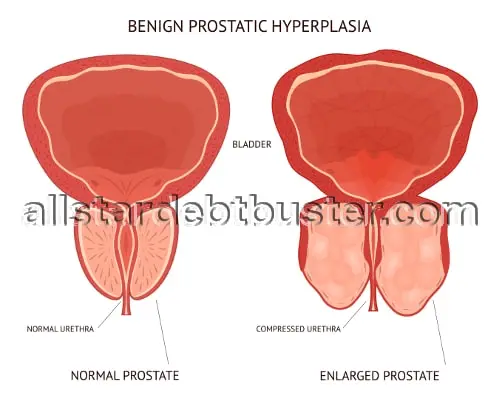

It's also worth noting that the symptoms of prostatitis can sometimes mimic those of other conditions, such as urinary tract infections or benign prostatic hyperplasia. This can sometimes make the condition difficult to diagnose without a thorough medical examination.

Common Symptoms

The symptoms of prostatitis can be similar to those of other urinary tract conditions, making it important to seek a proper diagnosis. Common symptoms may include:

- Pain or discomfort in the pelvic area

- Difficulty urinating, such as dribbling or hesitant urination

- Frequent urination, particularly at night

- Painful ejaculation

- Flu-like symptoms, in the case of bacterial prostatitis

It's important to note that the severity of symptoms can vary widely from person to person. Some men may experience intense pain, while others may have only minor discomfort or urinary symptoms.

Chronic forms of prostatitis, in particular, can have a significant impact on a person's quality of life. The persistent pain and urinary symptoms can cause considerable discomfort and inconvenience, and the condition can also lead to sexual problems such as erectile dysfunction or painful ejaculation.

Furthermore, the symptoms of prostatitis can often come and go, which can make the condition difficult to manage. Some men may have periods where they have no symptoms at all, followed by episodes where the symptoms flare up.

When to Seek Medical Attention

If you're experiencing any of the above symptoms, it's important to seek medical attention. While these symptoms can be caused by conditions other than prostatitis, it's crucial to get a proper diagnosis to rule out any other potential health issues.

It's particularly important to seek immediate medical attention if you have symptoms of acute bacterial prostatitis, such as fever, chills, and severe urinary symptoms. This form of prostatitis can be serious if not treated promptly.

Even if your symptoms are mild or come and go, it's still important to get them checked out. Chronic prostatitis can be a long-term condition that requires management to control the symptoms and prevent complications.

Remember, early detection and treatment can make a significant difference in managing the symptoms of prostatitis and improving your quality of life.

Causes of Prostatitis

Understanding the causes of prostatitis can be complex, as the condition can be triggered by various factors, and in some cases, the cause may not be identifiable. However, it's crucial to understand the common causes to aid in prevention and treatment.

While the exact cause of prostatitis isn't always clear, it's usually associated with bacterial infection or inflammation of the prostate. Other factors, such as nerve damage in the pelvic area or a weakened immune system, can also contribute to the development of the condition.

Bacterial Infection

In the case of bacterial prostatitis, the condition is caused by a bacterial infection of the prostate. Bacteria can enter the prostate from the bloodstream or by backward flow of infected urine into the prostate.

Acute bacterial prostatitis is usually caused by common strains of bacteria. The infection can start when bacteria in urine leak into your prostate. Antibiotics are used to treat the infection. If they don't eliminate the bacteria, prostatitis might recur or be difficult to treat. This is known as chronic bacterial prostatitis.

It's important to note that bacterial prostatitis, both acute and chronic, is the less common type of prostatitis.

Other Risk Factors

While bacterial infection is a clear cause in some cases, many cases of prostatitis come without a clear identifiable cause. However, several risk factors have been associated with the condition. These include:

- Being young or middle-aged

- Having a history of prostatitis

- Having an infection in the bladder or the tube that transports semen and urine to the penis (urethra)

- Having pelvic trauma, such as injury from bicycling or horseback riding

Understanding these risk factors can help in the prevention and management of prostatitis. If you fall into any of these risk categories, it may be beneficial to discuss prostatitis prevention with your healthcare provider.

It's also worth noting that while these risk factors can increase a man's chances of developing prostatitis, they do not guarantee that the condition will occur. Many men with these risk factors never develop prostatitis, and many men without these risk factors do.

Diagnosis of Prostatitis

Diagnosing prostatitis involves ruling out other conditions that could be causing your symptoms and determining what type of prostatitis you have. Your doctor will start by asking about your medical history and your symptoms. They will also perform a physical exam and may order some tests.

It's important to provide your doctor with as much information as possible about your symptoms, medical history, and any medications or supplements you're taking. This information can help your doctor determine the best course of action for diagnosing and treating your condition.

Medical History and Physical Exam

A thorough medical history and physical examination are crucial first steps in diagnosing prostatitis. Your doctor will ask about your symptoms, their duration, and any previous urinary or prostate problems. They may also ask about your sexual history and whether you've been exposed to sexually transmitted infections.

During the physical exam, your doctor may perform a digital rectal examination (DRE). During a DRE, the doctor inserts a gloved, lubricated finger into your rectum to manually examine your prostate. They will be checking for signs of inflammation or infection, such as swelling or tenderness.

Laboratory Tests

Your doctor may order several tests to help diagnose prostatitis and rule out other conditions. These tests may include:

Blood Tests

Blood tests can help your doctor identify signs of infection and other medical conditions. For example, a complete blood count (CBC) can show if your body is fighting an infection. Your doctor may also order a prostate-specific antigen (PSA) test. PSA is a protein produced by your prostate, and its levels can be elevated in men with prostatitis.

Urine Tests

Your doctor may collect a urine sample for laboratory analysis. A urinalysis can detect signs of infection, such as the presence of white blood cells or bacteria. Your doctor may also perform a urine culture to identify the type of bacteria that might be causing the infection.

Post-Prostatic Massage

In some cases, your doctor may perform a test called a post-prostatic massage. For this test, your doctor will perform a DRE and then massage your prostate. Following the massage, you will provide a urine sample, which will be checked for signs of prostatitis.

These tests can help your doctor determine the cause of your symptoms and the best course of treatment. However, in some cases, the cause of prostatitis may not be clear. In these cases, your doctor may diagnose you with chronic nonbacterial prostatitis or chronic pelvic pain syndrome.

Treatment Options for Prostatitis

The treatment for prostatitis depends on the underlying cause of the condition. In cases where prostatitis is caused by a bacterial infection, antibiotics are the first line of treatment. For chronic prostatitis, particularly chronic pelvic pain syndrome, the treatment may involve managing symptoms over the long term.

It's important to remember that treatment effectiveness can vary from person to person. What works for one person may not work for another, and it may take time to find the treatment that works best for you.

Antibiotics

For bacterial prostatitis, antibiotics are often the first line of treatment. The type of antibiotic prescribed can depend on the type of bacteria causing the infection. You'll likely need to take antibiotics for two to six weeks, but in some cases, longer treatment may be necessary.

It's important to take the full course of antibiotics, even if you start to feel better before you've finished the medication. This helps to ensure that the infection is fully cleared and reduces the risk of the infection returning.

Alpha Blockers

Alpha blockers are a type of medication that relaxes the muscle fibers in the prostate and bladder neck, which can help to improve urine flow and reduce bladder outlet obstruction. These medications are often used in the treatment of chronic prostatitis and chronic pelvic pain syndrome, particularly in men who have significant urinary symptoms.

Pain Relievers

Over-the-counter nonsteroidal anti-inflammatory drugs (NSAIDs) can help reduce pain and inflammation associated with prostatitis. For more severe pain, your doctor may prescribe stronger pain relievers. It's important to use these medications as directed by your doctor to manage your symptoms effectively and avoid potential side effects.

Prostate Massage

In some cases, your doctor may recommend prostate massage, which involves massaging the prostate to help reduce inflammation and pain. This treatment is typically performed by a doctor or a physical therapist. While it can be beneficial for some men, it's not suitable for everyone, particularly men with acute bacterial prostatitis, as it can potentially spread the infection.

Other Treatments

Depending on your symptoms and the type of prostatitis, other treatments may be recommended. These can include heat therapy, which involves applying heat to the perineal area to reduce pain and discomfort, and physical therapy, which can help to relieve pelvic pain and urinary issues.

In some cases, lifestyle changes can also help to manage the symptoms of prostatitis. These can include staying hydrated, urinating regularly, and avoiding substances that can irritate the bladder, such as alcohol and caffeine.

Remember, it's important to discuss all treatment options with your healthcare provider to determine the best approach for your specific situation.

Living with Prostatitis

Living with prostatitis can be challenging, particularly for men dealing with chronic forms of the condition. However, with the right treatment plan and lifestyle modifications, it's possible to manage the symptoms and maintain a good quality of life.

It's important to remember that everyone's experience with prostatitis is different. What works for one person may not work for another, and it may take time and patience to find the strategies that work best for you.

Diet and Lifestyle Changes

Some men with prostatitis find that certain dietary and lifestyle changes can help to manage their symptoms. These may include:

- Staying hydrated: Drinking plenty of fluids can help to flush bacteria out of your urinary tract, reducing the risk of infection.

- Avoiding irritants: Certain substances, such as alcohol, caffeine, and spicy foods, can irritate the bladder and worsen urinary symptoms.

- Regular exercise: Physical activity can help to reduce symptoms of prostatitis, particularly pelvic pain. However, it's important to avoid activities that can put pressure on the prostate, such as cycling.

- Stress management: Stress can worsen the symptoms of prostatitis. Techniques such as meditation, deep breathing, and yoga can help to manage stress levels.

It's important to discuss any dietary and lifestyle changes with your healthcare provider to ensure they're safe and appropriate for your specific situation.

Support and Resources

Living with prostatitis can be challenging, both physically and emotionally. It's important to seek support if you're feeling overwhelmed or struggling to cope with your symptoms. This could be from a mental health professional, a support group, or trusted friends and family.

There are also many resources available to help you understand and manage your condition. These include:

- Prostate Health Guide: This comprehensive guide provides information on all aspects of prostate health, including prostatitis.

- Prostatitis Foundation: This organization provides a wealth of information on prostatitis, including research updates, treatment options, and patient stories.

- Urology Care Foundation: This site offers a range of resources on prostatitis, including fact sheets, articles, and videos.

Remember, it's okay to ask for help and seek support. You're not alone, and there are many resources and support networks available to help you navigate your journey with prostatitis.

Conclusion

Prostatitis is a common and often frustrating condition for many men. While it can be challenging to diagnose and treat, understanding the condition and its various forms can help you to manage your symptoms and maintain a good quality of life.

With the right treatment plan and lifestyle modifications, it's possible to manage prostatitis effectively. However, it's important to remember that everyone's experience with prostatitis is different, and what works for one person may not work for another.

Key Takeaways

Prostatitis is a condition that involves inflammation or infection of the prostate gland. It can present in several forms, each with its own set of symptoms, causes, and treatment options.

While prostatitis can be challenging to live with, there are many treatment options available, and lifestyle modifications can also help to manage symptoms. If you're experiencing symptoms of prostatitis, it's important to seek medical attention to get a proper diagnosis and treatment plan.

Living with prostatitis can be challenging, but with the right support and resources, you can manage your symptoms and maintain a good quality of life.

Further Reading

If you're interested in learning more about prostatitis, there are many resources available. These include medical websites, health guides, and patient support organizations. Some recommended resources include the Prostate Health Guide, the Prostatitis Foundation, and the Urology Care Foundation.

Remember, while these resources can provide valuable information, they should not replace professional medical advice. If you have any concerns about prostatitis, it's important to speak with a healthcare provider.